|

cats health insurance: practical insight for smarter coverageThink big, act practical. Insurance turns unpredictable vet bills into a planned expense, but only if you select thoughtfully and understand what you're actually buying. What coverage actually meansPolicies slice risk into parts: accidents, illnesses, and sometimes routine care. The heart of protection lies in illness and accident coverage; wellness add-ons are convenience, not catastrophe buffers. - Deductible: annual vs per-incident. Annual is simpler for chronic issues; per-incident can sting after multiple events.

- Reimbursement: typically a percentage of the vet bill after the deductible. Higher reimbursement lowers surprise, raises premium.

- Limits: annual caps, per-incident caps, sometimes lifetime caps. Higher limits = better for rare, expensive events.

- Waiting periods: time before coverage starts; note special waits for orthopedic or dental conditions.

- Exam fees: some policies cover them, others don't - small detail, big difference.

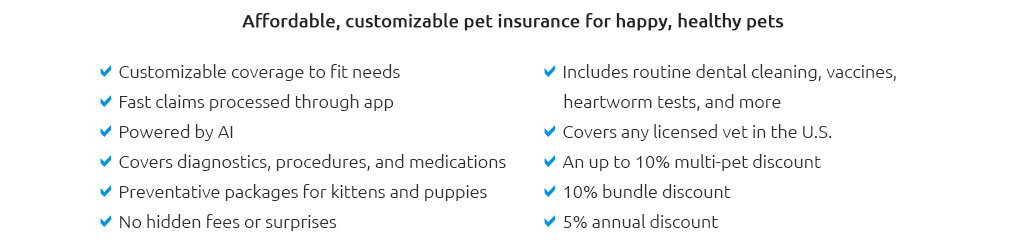

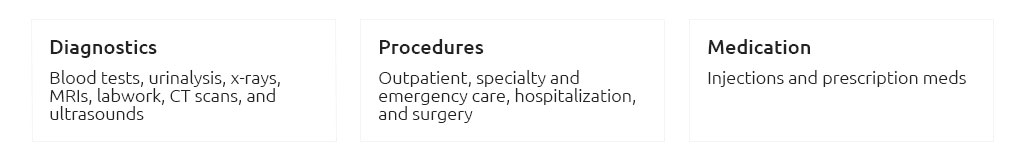

- Medications and diagnostics: x-rays, bloodwork, ultrasound, prescriptions - verify inclusion.

- Hereditary/chronic: ensure chronic and congenital conditions are covered once enrolled.

- Alternative and rehab: acupuncture, PT, chiropractic - nice to have if your vet uses them.

A practical selection framework- List your must-haves: illness + accident, exam fees, chronic condition support.

- Choose your risk posture: higher deductible for lower premiums, or lower deductible for frequent care.

- Check exclusions: dental disease, behavioral care, supplements, prescription diets.

- Assess claims experience: app-based filing, average payout speed, direct-pay options.

- Study renewals: premiums often rise with age and regional costs; expect it, plan for it.

- Read definitions: "pre-existing," "curable," "bilateral," and how co-insurance is calculated.

Costs and expectationsFor many households, premiums land in the "few tens of dollars per month" range for adult cats, climbing with age, breed risk, and richer coverage. Bigger limits and lower deductibles cost more; that's the trade-off you control. Pause. What risk are you actually transferring - and which costs are you fine self-covering? A real-world momentRainy Tuesday, sudden limp. The vet recommended x-rays and pain management. An accident-focused policy reduced a $480 visit to $90 out-of-pocket after the deductible and reimbursement - no drama, quick claim, cat back to pouncing by Thursday. That's the value: stress down, options up. Compare smartly- Coverage clarity: actual vet bill vs fee schedule reimbursement.

- Dentistry: injury-only or illness too (stomatitis, resorptive lesions)?

- Specialists and ER: any surcharge or separate limit?

- Chronic continuity: will coverage persist year to year without condition caps?

- Tele-vet: included consults can prevent unnecessary ER visits.

- Policy structure: annual vs per-incident deductibles, and when co-insurance kicks in (before or after deductible).

- Renewal behavior: how do rates respond to claims, age, and inflation?

Red flags and fine print- "Bilateral" rules that treat both eyes/knees as one condition can limit payouts.

- Long waits for orthopedic issues; know the timeline and any exam requirements to shorten it.

- Strict pre-existing definitions with no "curable condition" forgiveness.

- Low annual limits paired with low deductibles - cheap until a big year arrives.

- Wellness riders that merely prepay routine care without savings or broader benefits.

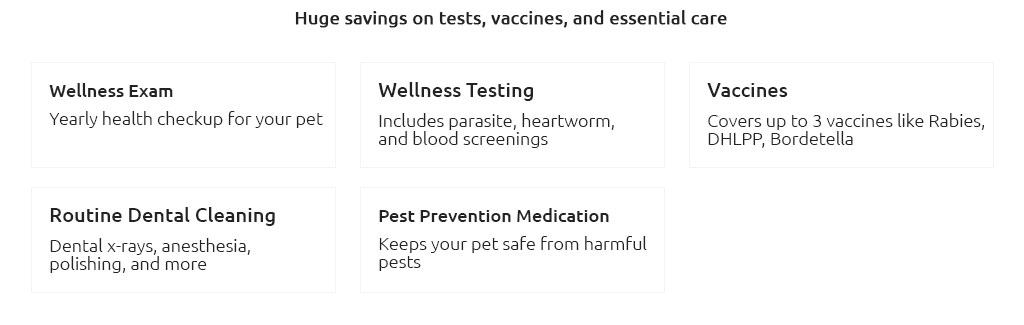

Make the numbers talk- Estimate a normal year: vaccines, checkups, occasional illness.

- Model a bad year: imaging, hospitalization, surgery, meds.

- Compute annual cost = premium + expected deductible + co-insurance in both scenarios.

- Weigh the "sleep at night" value against the price delta. Predictability has a real, if personal, worth.

Coverage styles that actually work- High-deductible, high-limit: efficient for rare but costly events; pair with a small emergency fund.

- Moderate deductible, solid limit: smoother out-of-pocket across common illnesses.

- Wellness add-on: skip unless it meaningfully expands coverage (exam fees, dental illness) or you prefer budgeting discipline.

Timing and enrollmentEnroll early, before conditions appear; continuity protects against exclusions down the line. If you move states, re-check rates and rules. Keep medical records tidy to speed claims. Questions that reveal real value- Are exam fees, dental illness, and behavioral care covered?

- Any sub-limits for ER, specialists, or prescriptions?

- Is reimbursement based on actual bill? Any fee schedule?

- Do bilateral conditions count as one incident?

- How are premium increases determined at renewal?

- Is there direct pay to the vet for large bills?

If insurance isn't the fitSelf-insure with an earmarked savings account, automate monthly transfers, and keep a backup line for true emergencies. Combine with a vet discount plan if available. The goal is the same: ensure care decisions are driven by medical need, not momentary cash flow. Closing insightGood coverage is clarity plus alignment: your cat's risks, your budget, and your tolerance for volatility. Choose for the bad day, not the good week. Get the terms right, keep expectations honest, and let the policy do its quiet work in the background.

|

|